Dollar cost averaging (DCA) is an investment strategy that involves buying a fixed dollar amount of an asset at regular intervals, regardless of the asset’s price. This strategy is often used by long-term investors who want to minimize the impact of market volatility on their investment returns.

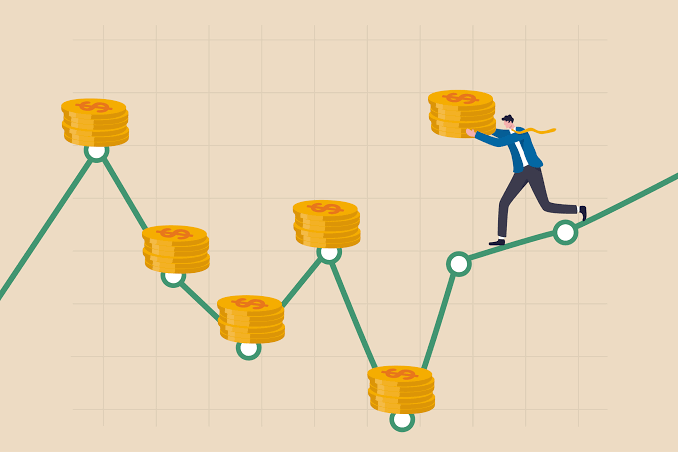

In the world of crypto, dollar cost averaging can be a useful strategy for investors who believe in the long-term potential of a particular cryptocurrency but are concerned about short-term price fluctuations. By buying a fixed dollar amount of the cryptocurrency at regular intervals, investors can potentially benefit from both the dips and the highs in the market.

For example, let’s say you want to invest $1,000 in Bitcoin over the course of a year. Instead of investing the entire $1,000 at once, you could divide it into 12 equal parts of $83.33 and invest that amount every month. This way, you’ll buy Bitcoin at different prices throughout the year, potentially benefiting from market dips and highs.

Benefits of Dollar Cost Averaging in Crypto

One of the main benefits of dollar cost averaging in crypto is that it can help investors avoid making emotional decisions based on short-term market fluctuations. By investing a fixed amount at regular intervals, investors can take a more disciplined approach to investing and avoid making impulsive decisions based on fear or greed.

Another benefit of dollar cost averaging in crypto is that it can potentially reduce the average cost of your investment. When you invest a fixed amount at regular intervals, you’ll buy more of the cryptocurrency when the price is low and less when the price is high. Over time, this can potentially reduce the average cost of your investment.

Risks of Dollar Cost Averaging in Crypto

While dollar cost averaging can be a useful strategy for long-term investors, it’s important to remember that it’s not a guarantee of investment success. Like any investment strategy, dollar cost averaging in crypto comes with risks.

One risk of dollar cost averaging in crypto is that you may miss out on potential gains if the price of the cryptocurrency rises rapidly. If you’re investing a fixed amount at regular intervals, you may not be able to take advantage of sudden price increases.

Another risk of dollar cost averaging in crypto is that you may end up investing in a cryptocurrency that doesn’t perform well over the long term. While dollar cost averaging can help you avoid short-term market fluctuations, it can’t guarantee that the cryptocurrency you’re investing in will be successful in the long run.

Leave a Reply